The energy transition: a simple transition

An affordable, reliable and resilient energy transition means replacing fossil-fueled power stations with zero-carbon generation and electricity storage. How much long-duration electricity storage (LDES) is needed depends very much on how the energy transition develops. That in turn depends entirely on the country’s energy decarbonisation strategy, regulations and market design: the more appropriate the regulations and market design are to the strategic end result, the more cheaply and efficiently that result will be.

This analysis will not only look at how much storage is needed, but how to minimise that requirement; and equally, how to minimise the cost, complexity and disruption of the entire energy transition.

Balancing services

The key target is to provide sufficient power during periods of low renewable generation, known as “times of system stress”. Such times could run from an evening peak without either wind or sun, to the kalte Dunkelflaute; the latter lasts up to a fortnight covering most of the continent of Europe; the former frequently occurs continent-wide for shorter periods including overnight. Other regions have their own comparable weather patterns.

However there are two more levels of provision that must be considered: seasonal and annual. Seasonal considers the seasonal variation in both generation and demand. Annual considers the fact that incident energy from the sun varies year-on-year, producing variations in wind, wave and other renewable energy too; this is only starting to be understood.

Other services

Power stations provide not only energy but also many other services: dispatchability (for which balancing services are needed), natural inertia (for system stability), power quality, Black Start and so on. So replacing power stations requires replacement of all these too.

Splitting all these services into separately-let contracts prevents simple solutions that address them all. No naturally inertial asset can deliver energy without also delivering reactive power, voltage and frequency control, inertia, phase-locked loops, power quality etc. If the contracts for these are let to different assets, then there are three choices, none of them tenable (this has been supported by a specialist lawyer):

- Take the additional services, in which case the inertial asset-owner would sue for theft and the other contract-winner would sue for breach of contract;

- Pay for the additional services, satisfying the inertial asset-owner but the other contract-winner would still sue for breach of contract;

- Penalise the inertial asset-owner, to pay the other contract-winner and satisfy them, but the inertial asset-owner would go bankrupt and be unable to deliver the energy contract.

For solutions to these, see the section on regulation, below.

Power generation

In a Net Zero world, power generation will be of the following types:

- Nuclear, in some countries;

- Geothermal;

- Dispatchable or baseload zero-carbon generation;

- BECCS (Bio-Energy with Carbon Capture and Storage);

- Fossil fuelled power stations with CCS;

- Intermittent renewable generation;

- Interconnectors.

Nuclear

Nuclear delivers baseload electricity, i.e. variable over periods of days or (preferably) weeks or months. It has very low marginal cost, comparable with that of wind or solar, and much longer plant life.

Some seek to make nuclear power dispatchable (i.e. variable on demand), but this is highly counter-productive. Varying nuclear power consumes damping rods and stresses reactor vessels, shortening plant life and increasing plant cost; it is also one of the purest forms of energy wastage as it prevents energy being produced – a form of high-cost curtailment. This is part of the reason why half the French nuclear fleet was out of action for maintenance in 2022.

However, as ~60% of demand is baseload, nuclear is ideal for running as baseload power – up to a limit of that 60%, or a little more if occasional drops in demand are stored. To that 60% level, no storage is needed as it is matched with that element of demand.

To deliver baseload electricity, 1GW nuclear generation would have to be replace with {~3GW offshore wind + 3GW LDES} or {4GW onshore wind + ~4GW LDES} or {6-10GW solar + 6-10GW LDES}. In each case, the duration of the LDES would have to be 2-3 weeks: the kalte Dunkelflaute, plus a bit in case a follow-on weather pattern delivers similar conditions before the storage is re-charged. Therefore, to minimise the storage needed, nuclear is very beneficial.

Geothermal

Geothermal energy is baseload energy that acts very similarly to nuclear. It takes heat from the earth’s core to provide energy for heat networks and sometimes power generation. Despite its many advocates, one must consider whether or not we really want to be cooling the earth’s core for our immediate energy use: after all, Mars is an earth-like planet whose core cooled.

Dispatchable or baseload zero-carbon generation

Dispatchable or baseload zero-carbon generation is largely from biomass (e.g. wood pellets, agricultural and forestry waste, bagasse, energy crops) and gas from anaerobic digestion and similar processes. This is because the emissions from combustion are counteracted by the absorption of those same chemicals during biological growth. Such systems deliver not only dispatchability but the ability to produce even during times of system stress. It must be borne in mind that carrying the feedstock long distances, or pre-processing it (e.g. forming and drying pellets), will usually add emissions to the process, so it would stop being zero-carbon generation.

For these technologies, the key question is the amount and source of the feedstock biomass. This is intrinsically limited: biological processes produce very little waste, as it is recycled into compost etc. The more biomass is extracted, even as “waste products of timber or agriculture”, the more quickly the soil will be depleted of its nutrients. And growing energy crops displaces food crops even while the world’s population (and average food consumption, especially of meat and dairy products) is increasing.

Other zero-carbon generation is from hydro-power, either dams or run-of-river. Provided that they have much greater environmental benefits than the harm that they do to aquatic eco-systems and flooded valleys, this is an excellent source of power. Depending on design, it can generate baseload or dispatchable electricity. Note that run-of-river generation may dry up during droughts and heat waves, which are becoming increasingly common as the planet warms.

Baseload renewables should be considered in the same way as nuclear. Dispatchable renewables need no storage, and reduce the amount of storage needed by the grid.

BECCS

BECCS adds CCS (Carbon Capture and Storage) to zero-carbon generation. This creates negative emissions, which are used primarily to offset hard-to-abate industries such as chemical manufacturing, plastics and aviation. Again, it is limited by the amount of feedstock.

Fossil fuelled power stations with CCS

Fossil fuelled generation is falsely considered zero-carbon: the processes to capture emissions aren’t 100% effective, so BECCS (or direct air capture, DAC) is needed to off-set it. The more off-set is needed for such power stations, the less is available for hard-to-abate sectors; therefore ideally there should be no fossil fuelled power stations.

There are further factors not usually considered when considering CCS, including:

- It imposes 30-40% inefficiency penalty on the power station;

- It costs a lot;

- It requires catalysts and consumables with their own lifetime emissions;

- Costing such schemes usually ignore the health-and-safety aspects of CO2:

- It is highly toxic, killing in as little as a single lungful, with many thousands having died from natural emissions in lakes in central Africa;

- It can’t be seen, smelled or tasted;

- It is 50% heavier than Chlorine gas, which was used as a weapon in the first world war, and therefore won’t disperse in light winds but instead roll over population centres.

However there are good uses for CCS, for hard-to-abate industries; and as long as a marine reserve with total exclusion zone is declared above any storage location (in case of release due to an earth tremor), its storage will be safe – and the fisheries will benefit as an incidental side-effect. More detail is here.

Intermittent renewable generation

Intermittent renewable generation produces electricity when it wants to, rather than when we want it to. This includes not only wind and solar, but also tidal (range and current) and wave energy. These all need storage to balance intermittency with the variability of demand.

The seasonality of each intermittent generation technology differs. In the UK, for example, there is more wind in winter and sun in summer. To minimise the amount of storage needed, one needs to match the seasonality of intermittent generation with the seasonality of demand: in the UK’s case, about 5:1 wind:solar. Other countries and regions will have ratios specific to themselves.

Interconnectors

Many believe that interconnectors will supply energy during times of system stress. This is a fallacy: most such times (e.g. after sunset on a windless winter evening) occur concurrently in neighbouring countries, who will therefore have no surplus to export. Indeed, the 2019 energy transition plans of nearly all European countries relied on imports during such times: if all are importing, who is exporting? The same applies to all other regions in the world.

It is also a fallacy to rely on existing contracts: which grid operator would be prepared to tell their government that a city’s black-out was because they were exporting the energy it needed? Indeed, when Germany was short of gas in 2022, they cut all their export interconnectors; later that year, Norway (one of the only countries planning to have a surplus during times of system stress) passed legislation enabling the government to override export contracts during such times. More detail is here.

Demand grid and modelling

The next strands to consider are demand, grid design and how the grid is modelled.

Demand

The UK is expecting to increase its renewable generation to ~180GW by 2050, to provide for peak demand rising to 80GW. This is an under-estimate in both peak demand and the renewables required to supply it, owing to losses for storage, and to the fact that the grid operator is doing its utmost to incentivise people to move their demand to low-demand periods, which would have the effect of greatly increasing the baseload percentage. It also ignores that the hydrogen economy must be electrically powered, which would double annual demand. Another omission is consideration that as temperatures drop below zero, so heat pumps get less and less efficient until finally they fail – just when demand will be at its highest. More detail is here.

Demand for electrolysis and hydrogen off-taking industries can be minimised by taking it entirely off-grid, using LDES – more detail here. That reduces the amount of storage needed on the grid, but not the total amount of storage needed. Moreover, it greatly reduces the amount of grid needed.

Grid design

Another way to reduce the amount of grid needed, and of other assets and costs on the grid, is to connect large-scale intermittent generation to the grid THROUGH storage of suitable scale and duration. Each new GW offshore renewable generation requires ~£3bn onshore grid reinforcement (without considering the cost of the grid connection itself), plus 10% of that per annum equally split between Operation and Maintenance costs, and finance / amortisation. It also requires procurement of billions of pounds worth of balancing, ancillary, stability, reliability, resilience, power quality and restoration services. The majority of all this need would be eliminated by such an arrangement of suitable behind-the-meter LDES. More detail is here.

Saving trillions

If these matters (Demand and Grid Design) are addressed immediately, then by 2050 the UK alone could save over a trillion pounds, and ~£150m per annum thereafter.

Grid modelling for the energy transition

Part of the problem is the grid’s statistical approach to forecasting. Two aspects of this are their use of de-rating factors and of dispatch models for medium- and long-term forecasting. De-rating factors are assumed to be the output that a plant provides. They are not: they’re an average between when it’s producing 100% and when it’s producing reduced amounts or nothing at all. When plants are all dispatchable, that difference doesn’t matter. When most are intermittent, they can all fail at the same time, such as a windless winter evening – and, because such weather patterns cross frontiers, our neighbours will often be suffering the same shortfall at the same time, further increasing the problem of averages.

Therefore any calculation of sufficiency of supply using nameplate capacities and de-rating factors will yield inadequate results. Applying these figures to the above comments on the under-estimation of supply would yield even more worrying results.

Dispatch models are excellent for looking at the grid today and in the near future. But National Grid, Ofgem and BEIS use them for the medium- and longer-term future too, where they break down. Every step into the future requires assumptions and educated guesses; the further into the future, the more important these are as a proportion of the whole. By about 3-5 years hence, the result is no longer credible. Instead, other means need to be found to establish the needs of the grid over such periods of time – methods such as below.

Calculating the need for storage

Current calculations

Currently each country and grid calculates its need for storage in very complicated manner, by creating a model with various scenarios, projecting different generation mixes all based on huge assumptions as to what will be rolled out in future. Using the UK’s National Grid’s annual Future Energy Scenarios as an example, every year their estimate of the storage needed by 2050 increases over the previous year’s estimate. In round numbers it is currently at 20-40GW storage (across all scenarios, including the do-nothing “steady progression” scenario) for a projected 80GW grid, with that requirement still rising. Last year’s 2050 storage requirements were 13-28GW, “mostly long duration” (which they define as over 4 hours). This begs two questions:

- Is there a simpler way to calculate storage requirements;

- If forecasts are increasing continually, what is the end point to which they are trending?

Urgency of the need

This is vitally important because if the requirement is underestimated, insufficient political, financial and operational investment will be put into it. Large volumes of storage will require a massive roll-out of new plants, however large these plants are. Lead times for financing, building and commissioning large-scale long-duration storage are long, so work needs to be started soon if this roll-out will be sufficient to achieve 2050 emissions targets.

There are two factors to be calculated: power (GW = Gigawatts) and energy (GWh = Gigawatt hours). It is easiest and clearest to calculate them separately. They must be calculated for the longest low-generation period forecastable – i.e. the kalte Dunkelflaute, which is a regular weather pattern (every 2 or 3 years) in which a high pressure system stations itself over most of Western Europe for periods of up to two weeks mid-winter (i.e. during peak demand and minimal solar generation) and during which maximum renewable generation is reduced by 90% or more.

Calculating storage power

Stored power = {peak demand} + {10-15% supply margin} – {total zero-carbon dispatchable generation capacity}.

The supply margin exists to accommodate failures in any part of the network or the plants attached to it, and/or unusual spikes in demand.

By coincidence (and nothing else), the UK’s expected 2050 zero-carbon generation happens to coincide with the supply margin. Therefore the storage power needed is equal to peak demand.

Calculating Storage Energy

Stored energy = {total demand} – {total zero-carbon dispatchable generation}.

This should potentially be up-rated for (a) deterioration of stored energy such as battery self-discharge or cooling of stored heat, and (b) any possibility of a follow-on extreme weather period before the stores are sufficiently re-charged.

The answer to this is likely to be proportionately lower than that to the Power calculation, because baseload generation delivers proportionately more energy than does dispatchable, and vastly more than the reserves held for supply margin.

Calculating plant sizes

Actual plant sizes will vary. Some plants need to have sufficient duration to operate as baseload during the weather pattern; others will provide for variable demand, at various utilisation rates. This is not a rigid distinction: shorter-duration plants, for example, can be used in a relay through the period, and plants can operate sometimes for an hour or less, and at other times for many hours.

The best way to calculate actual plant-size requirements is to model both supply and demand during the most extreme weather event. This should be upgraded on consideration of:

- Any degradation of stored energy, e.g. thermal cooling, or battery self-discharge;

- Any probability of a follow-on extreme weather period occurring before storage is sufficiently re-charged.

The final stage is to input the actual projects that are proposed, and re-run the scenario / calculation to determine the sizes of plants that remain to be developed.

What if the target is not Net Zero?

There are two answers to this: technical and strategic.

Technically, add all the permitted emitting generation to the total dispatchable generation factor in the two equations.

Strategically, the electricity grid is much easier and cheaper to decarbonise than many other sectors such as aviation, shipping, heating, industry. Therefore to minimise the cost and disruption of the energy transition we should target Net Zero grids in order to permit some excess emissions from other sectors, to enable the entire economy to meet 2050 targets.

Regulatory and market design changes

Avoiding paying for the wrong storage

All distributed systems rely on the transmission grid for back-up: it is impractical and unaffordable for them each to provide sufficient back-up for the more extreme times of system stress. That is why the grid was built in the first place. Moreover (as above) Black Start is impossible from lower-voltage grids to higher-voltage grids; it has to start at higher voltages and be rolled downwards.

As all rely on the transmission grid for back-up, therefore the transmission grid must have sufficient of everything to run the entire system in case of need, for the duration of that need. So the big issue is how to pay for the assets providing that reserve capacity: if paid for solely for reserve purposes, those reserve costs will be very expensive, but if they can defray all or part of their costs with other revenue streams, then the pure cost of reserves will drop and the overall system costs will reduce even if the costs of some of the other parts of the revenue stack may be a little higher than alternatives.

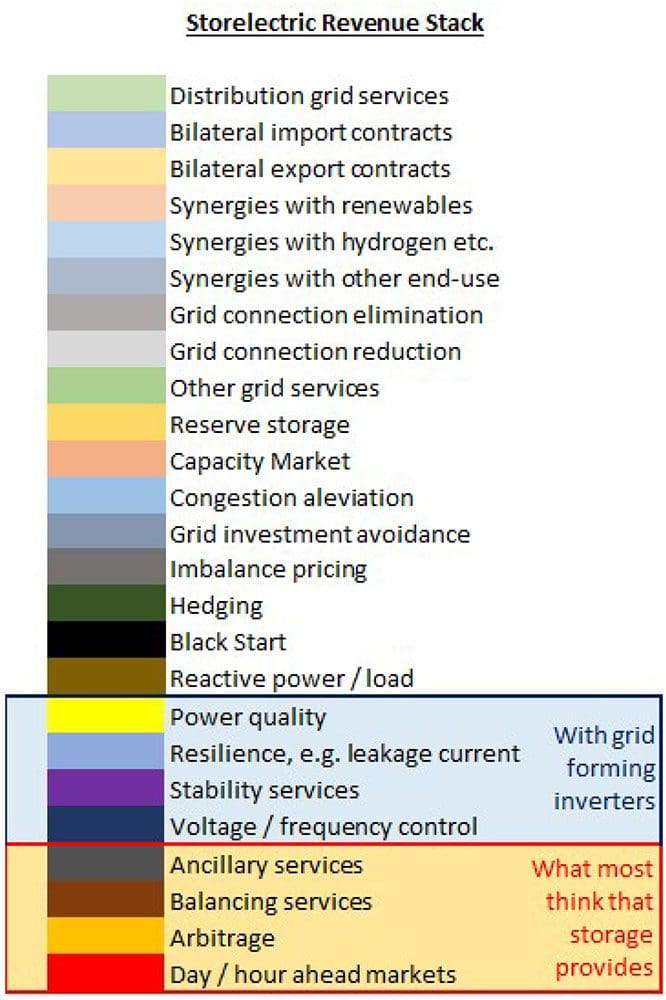

The revenue stacks for different types of storage differ very greatly – see diagram. The more elements of the stack that provide revenues and so defray the plants’ amortisation costs and contribute to profits, the less defrayal needs to be put onto each part of the stack – but only if the contracts are linked in some way. If contracts are not linked, then bids need to over-amortise/defray in case some bids are lost; the net result is over-amortisation on all contract types, increasing costs for all.

By over-amortising/defraying in each bid, then each bid may exceed the costs of other bids, encouraging the construction of additional assets to do the same job and thereby increasing the overall system costs without adding capability; whereas if the amortisation/defrayal were split across the revenue stack, the totality would be much cheaper.

Energy quality v quantity

Fundamentally, the problem is that the system pays only for quantity of energy, not quality. Each MWh is remunerated the same whether it’s intermittent and asynchronous, or dispatchable / baseload and synchronous:

- For each MWh of the former the System Operator needs to procure:

- Balancing services,

- Ancillary services (based on speed of response, for recovery from faults),

- Stability services (based on real inertia, to prevent faults cascading in the first place,

- System operability and resilience services (such as phase-locked loops and leakage currents),

- Power quality services (voltage and frequency forming, noise cancellation),

- Black Start (at a small additional cost, which needs a long-term contract).

- Also for the former, the Transmission Operator needs to reinforce the grid both for peak generation of intermittent electricity, and for separate provision of its balancing services; and also for separate provision of all the other services and for the separation in distance between the two.

- For each MWh of the latter, they don’t.

Therefore the value to the system of baseload / synchronous energy is much greater than that for intermittent / asynchronous. There are two ways of remunerating that difference that avoid the excess costs of over-amortisation/defrayal: to pay differently for different power types, and to link contracts for all the relevant services.

Other regulatory issues

By far the best way to reduce the overall cost of the energy transition is to connect all major intermittent generation to the grid through naturally-inertial (synchronous) storage of suitable scale and duration, as discussed above. However, because storage is never 100% efficient, that means that fewer MWh are sold to the grid, penalising the developer for delivering much higher quality energy and saving billions on grid costs. Paying for the quality of that energy rewards the developer for such benefits.

If storage is put between an existing wind farm and the grid, another wind farm the same size can be added to the same grid connections, eliminating all reinforcement. However, the OFTO regime does not allow for such cable diversions and business case changes.

The OFTO regulations also need clarifying: a cable between a wind farm and suitable behind-the-meter storage is an internal cable, as the storage and related power system is between the cable and the grid. This applies regardless of the size of that cable.

Taking the hydrogen economy entirely off-grid, and thereby avoiding the need to double the already-tripled grid size, should be encouraged and remunerated.

A simple, workable market design proposal

There is a conceptually simple solution to the market design, for which more detail is here. This, combined with an Emissions Added Tax (more details here) would mean that the costs of the energy transition will be borne (almost?) entirely by the industry, at (almost?) no additional whole-system costs.

The Emissions Added Tax would operate like VAT, crediting input emissions and charging output emissions. It can be charged at borders for imports, and credited for exports, if the trade is with other countries that charge less for emissions, to level the playing-field globally and support the national economy – both products and services.

The market design would recognise that the cheapest way to deliver a short-duration contract is to patch up a clapped-out and fully amortised asset. At the end of the contract, this is repeated; only it would be more expensive to patch up and operate, and fail more often. Eventually the asset dies of old age, and has not been replaced. However the cheapest way to deliver a 20-year contract is to build a new asset; over the 20 years the whole system costs less, and the asset base is replaced and updated.

Recognising that the asset life of typical transmission-connected assets is 40-60 years, one-third of all contracts should be let for 15-20 year durations – but only for new-build plants. One-third should be for half that duration – but only for new build or major modifications / overhauls / upgrades. The remaining third should be for short durations, accessible to all plants. The overall system costs would reduce, and the asset base would be continually renewed at no additional cost.

To reward power quality and avoid the over-amortisation/defrayal pitfalls, contracts should be made available for every single service needed by the grid, to all providers. (Traditional power stations, for example, are currently excluded from inertia contracts even though the grid needs it.) These should be let on a matrix basis. The contracts for which the fewest bids are submitted are identified as those hardest to let; these should be let first, together with all the other services that the asset cannot avoid delivering with it – linked contracts. (If that revenue stack can be delivered more cheaply in total by multiple other plants, then these should be awarded it.) Having deducted all those from the matrix, the next hardest to let is addressed, and so on down the revenue stack.

Next best options

Failing this, the next-best option is a revenue floor (without cap) for LDES, which is the major missing element. Almost as good is adding a “soft cap” whereby the LDES pays ⅓ of the profits above the cap. A “hard cap” (all of the profits) is counter-productive: markets exist to incentivise the best activities for all, and a hard cap destroys the working of those markets when the cap is approached. More detail is here.

Failing this, a CfD structure with remunerations for additional services would help, though with somewhat greater cost and complexity. Straight CfDs are useless: they only remunerate energy quantity, and generation plus storage will always cost more than generation alone; also it would fail to provide the other services needed from storage. More detail is here.