National Grid’s Future Energy Scenarios 2023 (NG’s FES 2023) is a small step forward on their 2022 document. It contains broader, for example considering aviation, shipping and railways (albeit only in terms of emissions, not energy consumption). We agree that “Whole system thinking helps decarbonisation” (p. 80); indeed, without it, decarbonisation will be unaffordable, impractical, excessively disruptive, unreliable and un-resilient.

It starts from a backdrop in which 2022-23 emissions were worse than in the previous year, for the first time in a decade. This is partly due to the end of the COVID lockdowns, though they had mostly finished by the beginning of that year. The main reason is the dire shortage of naturally inertial long-duration energy storage (LDES) in the right locations, which FES 2023 and its recommendations do little to redress. This suggests more than an element of magical thinking in the future energy projections.

National Grid provides a number of focal areas, which are addressed in turn:

- Focus on consumers,

- Policy and delivery,

- Consumer and digitalisation,

- Markets and flexibility,

- Infrastructure and whole energy system,

- Navigating a fair transition to Net Zero

Net Zero Electricity by 2035

Although ostensibly laudable, the aim to decarbonise the electricity grid by 2035 will make it unaffordable, unreliable and fragile because the need for naturally inertial long-duration energy storage (LDES) has been ignored until recently, and still doesn’t have the focus (strategy, regulations, market design) that it needs. Few (Storelectric’s are the exceptions) can be profitable merchants, in today’s market.

Effects of Climate Change

The effects of climate change on the electricity system appear not to have been considered at all. This is a very serious deficiency, which will affect supply, demand and networks in diverse ways. This has consequences in the technologies and network structure, which don’t even get a mention in FES.

Analysis of Demand

FES 2023’s analysis of demand explicitly excludes “additional demand for upstream primary energy sources or the conversion losses associated with production of some of these fuels, such as hydrogen” (p68) which would more than double electricity demand. Such large differences have very large-scale effects on the electricity supply, transmission, distribution and system operation. This gross omission makes the remainder of the report unreliable and of limited use for planning.

Negative Emissions

Quite correctly, the electricity system is targeted to have negative emissions by 2050 to balance hard-to-abate sectors such as aviation and agriculture. The current two technologies for this are BECCS and DAC (Bio-Energy with Carbon Capture and Storage, Direct Air Capture). DAC is a nascent but promising field, CCS more developed and (for power generation at least) less promising, for reasons discussed separately. There are also nature-based projects such as reafforestation and the planting of seagrass.

CCS is treated as carbon neutral, but is not: even omitting the supply-chain emissions (e.g. for capture catalysts), capture rates are always below 100%, meaning that there are emissions. These residual emissions can be very large: in the Boundary Dam project they often exceed 60%, and most other projects keep their figures confidential.

The U (Use and) in CCUS is treated as equivalent to CCS, but is not. Use of carbon is merely a delay in its emission. It is valuable inasmuch as it displaces emissions where used, but is highly susceptible to double counting.

Both BECCS and DAC are exceedingly expensive and energy intensive; their operation also needs to mitigate supply-chain emissions. BECCS is also limited in the amount of biomass that is available for burning, without constraining the world’s food supply. Therefore in a Net Zero or Net Negative emissions energy system, the need for them must be minimised. Ways of doing that include:

- Avoiding CCS generation where possible, other than BECCS, to minimise the additional negative-emissions plant required by the residual emissions;

- Avoiding unabated generation even more avidly;

- Only allowing zero-carbon generation and storage technologies.

FES does not take these three steps, instead relying greatly on CCS generation and ignoring its residual emissions; and unabated generation is included in the plans.

Electricity Storage

Despite many grave errors in the modelling that understate the need for storage, FES 2023 compliant scenarios require 33-52GW, 116-197GWh of electricity storage. Comparing the total GW and GWh of storage yields an average storage duration of 3.5-3.8 hours for the three Net Zero compliant scenarios. Given that nearly all battery storage is typically 1 or 2 hours, also stated in the report, that means that at least as much longer-duration storage is needed, of 4-12 hours duration. But under 4 hours average duration will not keep the lights on during the evening peak and overnight, let alone through the Kalte Dunkelflaute.

On that subject, the Dunkelflaute is analysed for the first time, a good start that needs further refinement as it still requires imports, does not consider our climate becoming more aligned with mainland Europe’s, errs in Germany’s expected generation mix and does not consider a similar but shorter follow-on weather pattern before storage is replenished.

Hydrogen

Despite omitting many of the largest potential uses for hydrogen, FES 2023 nevertheless identifies a huge need for it, widely varying between scenarios, of up to 431TWh hydrogen. Adding in those uses (such as industrial and chemical processes, synthetic fuels and complex compounds like ammonia) would greatly increase the total need for hydrogen, even if some of the less-likely uses cited in the scenarios were discounted. FES forecasts much less hydrogen than most other forecasters around the world.

29-46 days’ consumption is required. This is a massive amount, tens of TWh rising to hundreds if hydrogen demand is to grow to any close to most forecasters’ levels.

Focus on Consumers

The focus on “consumers” is still as strong and misleading as ever.

- Because a timescale is never mentioned, it means “consumers of today” at whose altar we sacrifice those of tomorrow, always seeking “least-cost options” for now, which eclipse all efforts at medium- and long-term considerations.

- The focus on the energy cost is the opposite of a focus on consumers because the cost of generating electricity makes up 20-25% of today’s electricity bills, down from 75-80% a decade ago, and dropping (which I analyse elsewhere this month). The rest is made up of the charges, levies and energy system costs that are escalating exponentially due to poor electricity system regulation and contracting.

Policy and Delivery

Policy and Delivery focuses on demand side strategy (both reducing demand and balancing demand profiles), energy efficiency (again reducing demand) and a focus on heat, which is about heat itself, largely ignoring how the energy is generated, distributed and balanced to produce that heat where and when needed. These are tickling the edges of the challenges, skirting around the edge of the big issues which are generation, storage, the transmission and distribution systems (network size and shape), integration of system and network thinking, enabling projects to benefit from improving overall system costs etc., reliability and resilience. Focusing so heavily on demand abdicates the challenge of ensuring sufficiency and security of supply.

Consumer and Digitalisation

This again misses the point. Digitalisation (ungrammatical as it is, it should be digitisation) merely optimises the use of energy in the system; it doesn’t ensure that there’s enough there in the first place, or with suitable reliability, resilience or energy security. It cuts margins to the bone, virtually eliminating the ability of consumers to change behaviour or systems to react if there is some substantial change, such as a faster or slower roll-out of EVs, or energy supply challenges.

While it’s important to educate consumers and help them change for Net Zero, the effects of most such initiatives (e.g. Smart Meters [which can at most reduce consumers’ bills and network peak demand by ~5% according to their own publicity or, more realistically, 1-2%], though smart-charging EVs [a much more marginal exercise than claimed] is additional to that figure) is at best marginal. Other experts looking at an average £693 increase in energy bills think that as much as a mere £75 could be saved, in comparison with the price cap expected to rise to £2,800 by October – that’s just 2.7% and assumes that all consumers will have the time, inclination, incentive and ability to maximise their benefits: of those that have the inclination and ability, how many are earning little enough for £75 p.a. to be sufficient incentive?

Markets and Flexibility

There is still excessive focus on demand-side flexibility, and on scale to the exclusion of duration. There is no reflection on the extent to which it benefits or harms the wider electricity system. Yes, it adds flexibility options now, but it also reduces the price volatility on which (for lack of specific contracts) National Grid, Ofgem and the government are relying to incentivise storage.

The same applies to storage: they incentivise and celebrate it divorced from the concept of duration, Yet, above a certain level (to be calculated), contracts for short-duration storage cannibalise the revenue stack of long-duration storage (LDES). As there are many functions that the latter can do but the former cannot, this means that to incentivise LDES, the prices of those unique capabilities must rise to compensate. Therefore, above that level, such contracts merely add cost without adding capability.

Again, the focus on flexibility without duration misses the question of energy security. Omitting grid stability misses the questions of reliability and resilience.

Locational signals, if taken to National Grid’s natural conclusions, will sub-divide our 50-100GW grid (depending on whether we’re looking at now or the future) into hundreds of tiny sub-markets which, of their nature, will disadvantage the large and broadly-capable solutions that the grid most needs. Moreover, some of the technologies most essential to Net Zero (e.g. wind, large-scale long-duration inertial storage) have to be put in specific regions; penalising them inordinately for doing so would make the energy transition unachievable.

And market participation is geared around bringing into the grids ever increasing numbers of participants at the distribution level, small scale and short duration, which are exactly what is driving up the costs and hurting the reliability and resilience of the transmission grid.

Current regulations and market design have already led to a situation in which Wystem Operation costs grow over 14 times in the three years from when the UK crossed the threshold 16% renewables (because we have LDES for 5% of demand; the threshold would differ elsewhere). Each new GW of offshore wind requires over £3bn onshore grid reinforcement plus £300m p.a. thereafter, even without considering its effects on system operation costs and other related matters. There is no consideration of any of these things, of how and why we got into this position, or of how to improve matters.

Infrastructure and Whole Energy System

The whole-system thinking that is presaged by National Grid’s Pathways to 2030 Holistic Network Design document (which I analyse elsewhere this month) is far too short-term to achieve the objectives without wasting a fortune on future re-work and without building enough grid to encourage new Net Zero compatible projects to come forward.

Inter-seasonal storage is just an assumed need. And National Grid seeks to jump to addressing it before (a) addressing the long-duration energy storage needs, i.e. 4 hours to 2.5 weeks duration, (b) determining how much seasonal storage is needed or (c) imagining any ways in which to incentivise reserve – which is why, in gas, the UK has just 3 days’ reserve as compared with 3-9 months as standard in continental Europe.

Whole system competition is only about delivering something similar to what NG engineers have conceived. There is no concept that others may have ideas, initiatives and projects that offer radically improved alternatives (such as Storelectric’s proposal to halve the size of grid needed for each offshore wind farm, with many other linked benefits) or considering any way of sharing the benefits with such project developers.

Grid Network

Analysis of the grid is incorporated into FES for the first time. This is a big move forward, but forecasts a doubling of grid capacity: most forecasters expect more than a tripling to accommodate the transition to renewables under current regulations and markets. As hydrogen is not fully considered, that should be doubled again. Consequent recommendations are not made, e.g. to put the hydrogen economy off-grid with LDES, and to connect renewables to the grid with LDES, that would mean that the grid only needs to be sized for electricity demand (and not power most electrolysis), rather than for intermittent supply. The potential savings are well over a trillion pounds in capital costs and £150bn p.a. operationally and financially.

Navigating a Fair Transition to Net Zero

Without all the considerations above, the transition to Net Zero will not be fair, affordable, reliable or resilient. Despite the section headed such on p13, National Grid is not “seeing the whole picture”, excluding, for example:

- Medium- and long-term thinking;

- Large and broadly capable solutions;

- Solutions with cross-over benefits between network and system;

- As well as their many other shortfalls detailed in this document.

Regionalisation

Today the UK has a 50GW grid and (mostly) 50GW markets. There is some, but limited (e.g. TNUoS) regional incentivisation to push developers to think carefully about where they put their proposals.

National Grid wants to greatly enhance these regional signals, which is fine for those projects (e.g. batteries) that can locate anywhere but will make projects without such flexibility (e.g. offshore and onshore wind, large-scale long-duration storage of any type) much harder to fund. And by doing so, it would make the energy transition as a whole unachievable: how can we generate enough power without locating the offshore wind beyond the furthest extremities (north, north-west, north-east and south-west) of the British Isles? How can security of supply, energy affordability and sufficiency, and grid reliability and resilience be achieved (i.e. all those factors together, not just some of them) without large-scale, long-duration, inertial storage?

Another result of regionalisation is to salami-slice the current single markets for most grid services / products, which are 50GW but rising towards 100GW, into numerous mini-markets. Just look at retail to see what that means: reducing volume and variety while increasing costs both of the products themselves and of doing business. Suddenly a GW-scale solution would become so dominant in its mini-markets that they would not be permitted to contract at the scale most suited to their technology.

Their intense lobbying to magnify locational pricing is one of the worst possible ways forward. Not only is most generation, storage (other than batteries) and demand fairly locationally inflexible, but locational incentives would change over time based on grid reinforcement actions, meaning that investors cannot forecast their costs, so killing investment incentives. It is a high volume low margin business, so increasing locational incentives above their present levels is totally destructive.

Net Zero

The energy transition is about replacing hydrocarbons with zero-emissions technologies, so Net Zero technologies must be at the scale of hydrocarbons (i.e. of power stations), or the objective will be missed by a very wide and/or costly margin. The power stations deliver energy, availability / dispatchability, grid stability, reliability, resilience, energy security, Black Start and other capabilities at the same time, indeed they do so concurrently with the same plants; therefore Net Zero technologies must do all these too: otherwise the energy transition will be unaffordable, unreliable and fragile which will lose both public and political support for it.

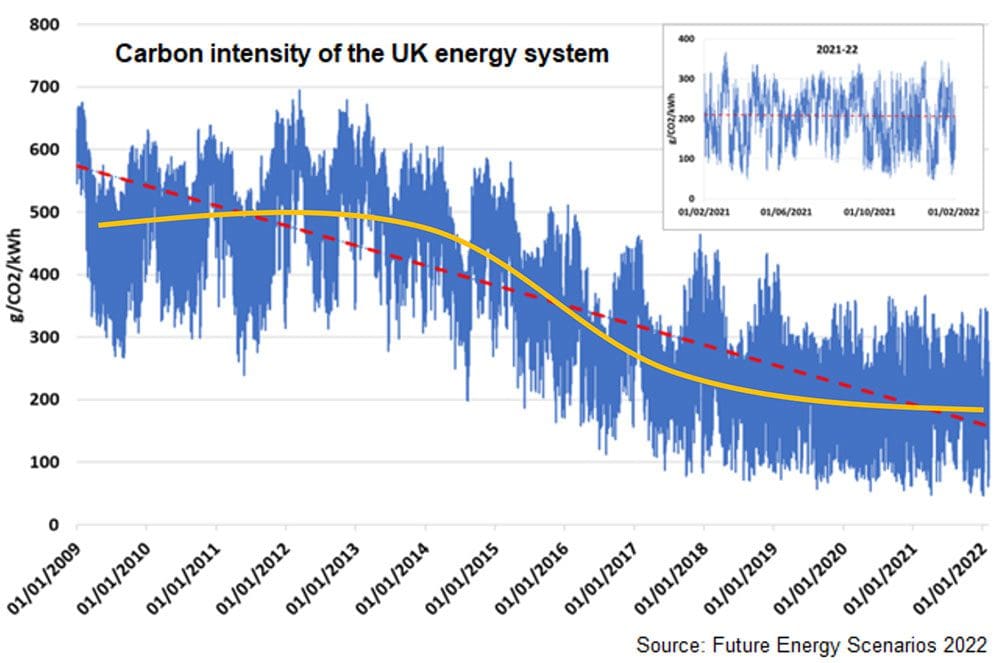

The British grid’s carbon intensity is shown in FES 2022 (but ignored this year) to be decreasing fast – though it increased recently, hopefully a brief up-tick. However, that is utter complacency, supported by fitting a straight line as a trend (the red dotted lines): the true trend (orange solid line) is an S shape, which would show that the grid’s carbon intensity largely levelled out from 2019 and shows little sign of further improvement, as shown by the inset graph which flat-lines over the last two years. Indeed, without sufficient large-scale, long-duration, naturally inertial storage, and the regulatory and contractual arrangements to encourage it, little further improvement is achievable. This calls into question whether any of the scenarios, on business as usual, will even come close to Net Zero as it questions whether the power sector would decarbonise at all, let alone by 2035.